3.1. An increase in government debt

Because of finitely lived households Ricardian equivalence does not hold in this model. In this

experiment we show the degree in which Ricardian equivalence is violated by showing the real

interest rate response of an increase in the debt to GDP ratio in Europe of 10% points. Enders and

Hubbard (2004) provide a summary of recent research (in the US case). Their reported estimates

for a 1% point increase range from zero to 24 basis points. Their preferred estimate lies between 2

and 3 basis points. Our model is more Ricardian than the results obtained by Engen and Hubbard.

A 1% increase in the debt to GDP ratio increases the long run real interest rate by slightly less than

1 basis point. Notice this result is obtained by increasing government debt in Europe only. The

results obtained in standard regression analysis are probably biased upwards because the debt

dynamics are positively correlated internationally over the sample period used for the regression

analysis.

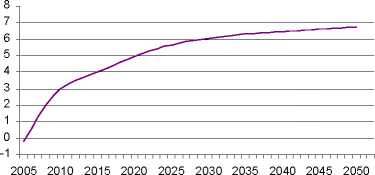

Figure 1: Increase in Government Debt (10% points)

Real Interest Rate

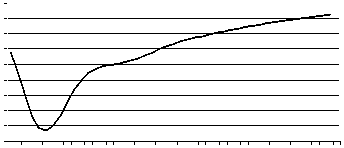

Share of Financial Wealth of Pensioners

0,006

0,004

0,002

0

-0,002

-0,004

-0,006

-0,008

-0,01

-0,012

2005 2010 2015 2020 2025 2030 2035 2040 2045 2050

After 50 years the real interest rate increases by about 7 BP and the capital stock declines by about

1% and GDP by around .3%. The effects on the intergenerational wealth distribution are minor.

This compares to Gertler’s closed economy case where a 10% increase in government debt leads

to an increase in interest rates of about 25 BP and reduces the capital stock by roughly 2.5%

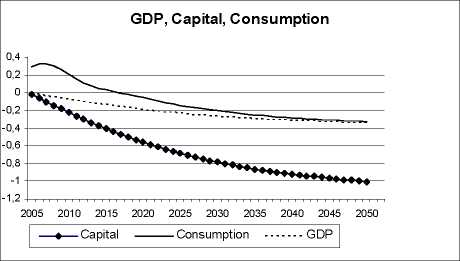

3.2. A reduction in pensions

In 2005, the share of pensions in total GDP is roughly 11%. What would happen if the pension

system would become less generous? In this experiment it is assumed that the share of pensions in

total GDP would be reduced by 2.5% points (gradually phased in over a period of 10 years). This

corresponds to the pension experiment conducted by Gertler for the US. The most important

question is, how such a reform would increase financial wealth and in particular capital

accumulation. A less generous pension system in the EU would increase savings and reduce

81

More intriguing information

1. Reconsidering the value of pupil attitudes to studying post-16: a caution for Paul Croll2. Secondary school teachers’ attitudes towards and beliefs about ability grouping

3. EMU: some unanswered questions

4. Optimal Tax Policy when Firms are Internationally Mobile

5. Improving Business Cycle Forecasts’ Accuracy - What Can We Learn from Past Errors?

6. The Economic Value of Basin Protection to Improve the Quality and Reliability of Potable Water Supply: Some Evidence from Ecuador

7. The name is absent

8. The InnoRegio-program: a new way to promote regional innovation networks - empirical results of the complementary research -

9. Uncertain Productivity Growth and the Choice between FDI and Export

10. The Clustering of Financial Services in London*