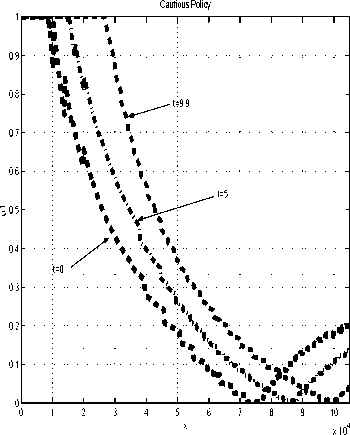

The optimal investment- policy17 uɪ, called “cau-

tious”, is shown in Figure 22. The target is ⅛ =

1OO,OOO.

400

Fig. 22. A cautious policy.

350

300

cautious strategy

x0=73500; Ex10=99541

250 ^.....cautious'strategy...........■'

X0=60000;Exi0=84686 : ,'∙∙4

median=86399 : :

200 -........ (.........(.........(∙

150-∙

100-∙

50-

x1-0^

∣ max expected value strategy :

∕x0=735OO)E<io=1672OO ;

'I median= 84015 : :

11111 111 I lJljijJL.JjjjjjJj-.iij-

0 0.2 0.4 0.6 0.8 1 1.2 1.4 1.6 1.8 2

x 105

The solution is intuitively explicable: if there is a

shortage of funds, or time, the manager’s actions

become risky. In other words, the policy lines get-

higher and steeper as .τo falls. Also, for the part- of

the strategy graph where it- is impossible to meet

the target- xτ by investing in the riskless asset-

only (i.c., before each line hits 0.), each policy line

representing a later time dominates the lines that

correspond to earlier times.

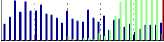

The usefulness of the cautious strategy for pension

fund management- can be assessed from Figure 23.

Fig. 23. A policy comparison.

Overall the cautious strategy appears an attrac-

tive portfolio management- policy. However, to use

it- for pension advertising, or for pricing the .Тю

“bond”, the objective function should reward the

manager for exceeding a target- (here, $100,000)

more than the square root- term18 .

An optimal control problem with g (ɪ (t ), и (t ), t) ≠

0 and s(X(T)) = e~eτx(T} i.c., one in which

a combination of the final wealth and the util-

ity from consumption is maximised, can also be

solved using the above approximation method.

The cautious strategy was used to manage two

initial payments x0 of $60,000 and $73,500. The

corresponding yield spreads arc represented by the

two central histograms in Figure 23. It- is easy to

see that the risk indices VaR and CVaR will be

very small for the first- outlay and virtually zero

for the second. For comparisons, the background

“back-t-o-back” histogram represents the result- of

managing the second payment- using the expected

value maximisation strategy. Oncc again we can

see that results worse than a “secure” investment

outcome ($99,215 in this ease) arc very probable.

6. CONCLUSION

A discretisation method useful for AIarkovian

approximations of finite-horizon continuous-time

stochastic optimal-control problems has been de-

scribed. An optimising algorithm has been devel-

oped (see [18] ) and applied to solve a portfolio

selection problem. For the calibrated models, an

overall agreement- between the analytical (where

obtainable) and approximating solutions was no-

ticed. However, a large variance of utility real-

isations was observed. It- was also noticed that

the variance diminished for constrained optimal

solutions.

In the example with variable volatility, no dif-

ference was reported in consumption patterns

between periods of low and high volatilities.

17Tho rest of the problem parameters are as before Lo.,

T = 10, u2 = .02, r = .05, etc.

lsFor example, (xτ - xτ)10 could be tried.

15

More intriguing information

1. Social Cohesion as a Real-life Phenomenon: Exploring the Validity of the Universalist and Particularist Perspectives2. On the Desirability of Taxing Charitable Contributions

3. The Clustering of Financial Services in London*

4. Do imputed education histories provide satisfactory results in fertility analysis in the Western German context?

5. The Dynamic Cost of the Draft

6. Measuring Semantic Similarity by Latent Relational Analysis

7. Macro-regional evaluation of the Structural Funds using the HERMIN modelling framework

8. Uncertain Productivity Growth and the Choice between FDI and Export

9. The name is absent

10. Orientation discrimination in WS 2