1.2

1

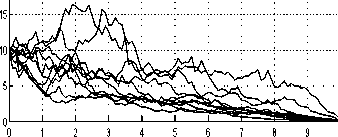

at the constraint. However, this does not affect

the consumption strategy. The new discounted

total utility is 717 and the standard deviation

equals 108, which is substantially less than un-

der the unconstrained regime. The wealth and

strategy sample paths are shown in Figure 18.

The conservative investment strategy results in

much less “volatility” in consumption and wealth

as observed by eye and measured by the utility

standard deviation.

0.4

0.2

0.8

м

= 0.6

2

4

6

8

10

0

wealth χi04

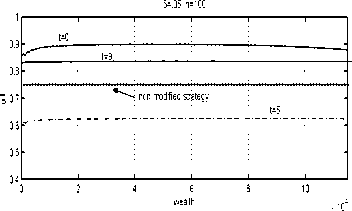

Fig. 15. Cosine modified strategies.

x 104

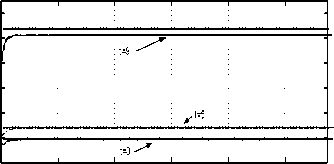

Cosine modifies realisations

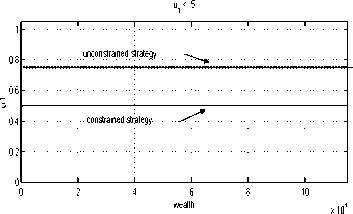

Fig. 17. Constrained strategies.

Fig. 16. Cosine modified realisation paths.

5.2 Constrained Policies

1∣-........!.........!.........!.........■.........!.........!.........■.........I

= 0.5---------------:----------------:----------------`----------------`----------------:----------------`----------------`-----------------

A portfolio manager might have an a, priori belief

that their investment should not exceed a certain

wealth percentage. Such a constraint can easily be

allowed for in the above numerical optimisation

procedure.

Suppose that the permissible investment level is

Ui = .5. Figure 17 reveals the modified strategy.

Not surprisingly, the agent is expected to invest

0---------------------1---------------------1---------------------∣---------------------1---------------------1---------------------1---------------------1---------------------1---------------------L

0 1 2 3 4 5 6 7 8 9

x 104

61---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------Γ

0∣---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------L

0 1 2 3 4 5 6 7 8 9

Fig. 18. Constrained strategy realisation paths.

12

More intriguing information

1. MULTIPLE COMPARISONS WITH THE BEST: BAYESIAN PRECISION MEASURES OF EFFICIENCY RANKINGS2. Dementia Care Mapping and Patient-Centred Care in Australian residential homes: An economic evaluation of the CARE Study, CHERE Working Paper 2008/4

3. The name is absent

4. Fortschritte bei der Exportorientierung von Dienstleistungsunternehmen

5. Voluntary Teaming and Effort

6. The magnitude and Cyclical Behavior of Financial Market Frictions

7. A Classical Probabilistic Computer Model of Consciousness

8. Growth and Technological Leadership in US Industries: A Spatial Econometric Analysis at the State Level, 1963-1997

9. Concerns for Equity and the Optimal Co-Payments for Publicly Provided Health Care

10. The Modified- Classroom ObservationScheduletoMeasureIntenticnaCommunication( M-COSMIC): EvaluationofReliabilityandValidity