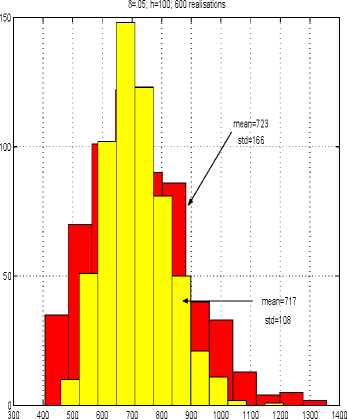

An impact- of the investment- constraint- on the

expected performance can be observed in more

detail in Figure 19. Two histograms of the dis-

counted total utility realisations arc presented.

The dark shadowed one corresponds to the un-

constrained policies (compare Figure 14). The

light- histogram represents the constrained pol-

icy performance. Evidently, the constrained policy

guarantees more “secure” performance (standard

deviation = 108 vis-à-vis 166 of the unconstrained

policy). However, the unconstrained policy brings

a (marginally) higher utility value. More compu-

tations of that kind would generate the “efficient-

boundary” .

utility

Fig. 19. Utility realisation distributions.

In a similar way, another portfolio problem, in

which some minimal (or maximal) consumption

rate is given could be solved.

5.3 Pension funds

A practical problem of financial engineering is one

in which an agent- pays an amount- .τo to a pension

fund, to be repaid by a quantity xτ at time T. The

latter is a result- of an investment- policy uι(.τ)

adopted by the fund’s manager.

The manager’s policy depends on his or her ob-

jective function, which could be the maximisation

of an expected value, the minimisation of risk to

obtain a target- amount-, etc. Oncc the objective

function is revealed, the manager’s policy can

be computed as a solution to a stochastic opti-

mal control problem associated with the objec-

tive function. The problem solution will routinely

comprise an optimal decision rule uι(.τ), U2(x)

and a Monte-Carlo simulated distribution of xγ∙

Knowing the former is crucial for the manager to

control the portfolio. The latter is “practical” in

that it- tolls the pension buyer what they can, or

should, expect- as xτ-

Knowing the distribution of xγ also helps the

manager. It- gives them an idea of what prob-

abilities, or risks, arc associated with obtaining

particular realisations of the objective function.

For example, the distribution may suggest- that,

for every .tq there is a probable terminal value

xτ, which the manager may choose to advertise

as the pension target-

Wc will first- solve a pension fund problem for

the expected value criterion, as follows. In (4),

set- <z(X(t),u(t),t) = 0, s(T(t)) = .τ(T) 12

and suppose that the management- fee is 2%.τ(t).

This means that we need to solve an optimisation

problem in uɪ(æ) with U∙2(t) = .02.τ(t).

Using the Markovian approximation approach as

in Section 4.2, with the same model parameters

i.c., T = 10, r = .05, etc., generates a rather

trivial optimal strategy: t⅛ιt = l,U2,t = ∙02.τf for

positive states and times. Applying the strategy to

different- initial outlays .f,o generates the following

final fund yield spread and location measures13

at T = 10, see Figure 20.

The figure toll us, among other things, that an

initial deposit- of $40,000 corresponds to the ex-

pected pension value of about- $100,000. However,

the median fund’s yield for this objective function

is significantly below the mean. This indicates

that the fund distribution is skewed, which is evi-

dent- from Figure 21 (upper panel). The histogram

shows us too that the probability of earning less

than the “secure” revenue

40,000 cxp{(r — “management- fee") 10} = 53,994

is more than .5.14 It- is even fairly probable

(with probability >.4) to earn less than the initial

outlay .τo = 40,000. Evidently, using a policy

that maximises the expected yield is a very risky

strategy of managing a portfolio.

12Horo, the objective function is not HΛRΛ.

13Avoragod over 1000 realisations.

14To prove this and the subsequent claims integrate the

area under the histogram from zero to 53,994 and 40,000 ,

respectively.

13

More intriguing information

1. The name is absent2. Multifunctionality of Agriculture: An Inquiry Into the Complementarity Between Landscape Preservation and Food Security

3. The name is absent

4. Innovation Trajectories in Honduras’ Coffee Value Chain. Public and Private Influence on the Use of New Knowledge and Technology among Coffee Growers

5. The name is absent

6. ‘I’m so much more myself now, coming back to work’ - working class mothers, paid work and childcare.

7. The name is absent

8. Imperfect competition and congestion in the City

9. Comparative study of hatching rates of African catfish (Clarias gariepinus Burchell 1822) eggs on different substrates

10. Barriers and Limitations in the Development of Industrial Innovation in the Region