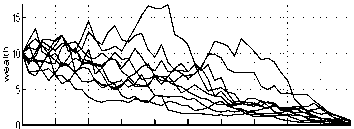

Approximated Realisations. Average Utility = 748

x 104

ip

0 1 2 3 4 5 6 7 8 9

tions ∈ [159,162]).10 Averaging the utility over

more realisations and diminishing the simulation

step could help to improve the utility variance

estimate. However, the improvement would not be

substantial, as the portfolio pcrfomancc is highly

“volatile” whether optimal (Figure 4) or not (Fig-

ure 13).

□ 0.5-

5. PORTFOLIO MODEL MODIFICATIONS

0∣---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------1---------------------L

0 1 2 3 4 5 6 7 8 9

Fig. 13. Approximated wealth, investment and

consumption rate realisations.

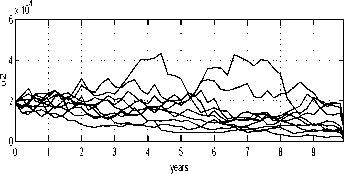

Fig. 14. Utility realisation distribution.

5.1 Time Varying Parameters

σ(t) = σ ɑ — 0.09 cos ŋ

(36)

Suppose now that the agent- expects the volatility

coefficient- σ to vary as follows

where σ = .4. This means that the volatil-

ity σ used in Sections 3 and 4 was an average

value. Now, the volatility will rise from 36.4 %

to 43.6 % in the middle of T, and then drop. The

agent- would like to know whether this information

should change their investment- strategy or not-.

Figure 15 reveals the modified strategy obtained

as a solution to the discrct-iscd portfolio problem

with ∂' = .05 and h = 500. As expected11, the

agent- will invest- more (i.c., above .75) when the

volatility is low. The solution is “exact” in that we

can read how much one has to invest- at each time.

Interestingly, the optimal consumption strategy

remains unchanged.

The wealth and strategy sample paths for the

cosine volatility problem arc shown in Figure 16.

The discounted total utility is 664 (std=158).

In summary, the agent- should modify their in-

vestment- strategy once the information about- a

volatility scenario becomes available. In a similar

way, a portfolio problem with a time dependent-

interest- rate (or other parameters) can be solved.

as judged by index J for other approximating

rules (c.g., ∂' = .05, .02 and h = 500, 100) was

comparable (J ∈ [701, 720] with standard devia-

10Howovor, using ∂' = .5, h = 10000 that is clearly a “bad4’

policy, resulted in J = 124.13 with the standard deviation

equal 100.

11 Soo footnote 19.

11

More intriguing information

1. Quality practices, priorities and performance: an international study2. The mental map of Dutch entrepreneurs. Changes in the subjective rating of locations in the Netherlands, 1983-1993-2003

3. The name is absent

4. Feeling Good about Giving: The Benefits (and Costs) of Self-Interested Charitable Behavior

5. The name is absent

6. Bargaining Power and Equilibrium Consumption

7. PERFORMANCE PREMISES FOR HUMAN RESOURCES FROM PUBLIC HEALTH ORGANIZATIONS IN ROMANIA

8. The name is absent

9. Growth and Technological Leadership in US Industries: A Spatial Econometric Analysis at the State Level, 1963-1997

10. The name is absent