4. A CALIBRATED MODEL

4

x 104

12∣-------

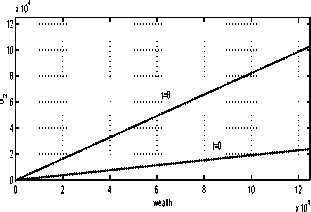

Portfolio Selection. Expected Values

4.1 The reference solution

10

Suppose an agent with an original wealth of ar0 =

$100,000 wants to maximise their satisfaction

during the coming T = 10 years. The instanta-

neous satisfaction is measured by ʌ/ɛ^(t)- The

risk free asset price drift is r = .05 and that of the

risky asset is a = .11 with the volatility σ = .4.

The agent’s discount rate is ρ = .11.

For these parameter values, the agent’s expected

discounted total utility is J = ρ(0)√100000 =

723.09. Figure 2 presents the optimal strategies;

the expected wealth and consumption rate time

profiles are shown in Figure 3.

Wealth

Consumption Rate

1

2

9 10

0

3 4 5 6 7 8

years

Fig. 3. Optimal expected wealth and consumption

rate time profiles.

Optimal Strategies

1

0.8

0.6

0.4

0.2

0

0 2 4 6 8 10 12

4

x 104

Fig. 2. Optimal (reference) strategies.

Optimal Realisations. Average Utility = 751

x 104

iF

0

0 1 2 3 4 5 6 7 8 9 10

□ 0.5-

6

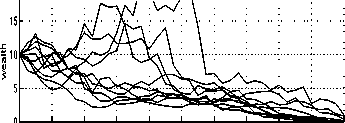

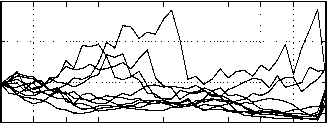

Figure 4 shows ten wealth and strategy time

profiles, which correspond to ten noise realisations

dw(t), t ∈ [0,T], obtained from a random number

generator. The average total discounted utility of

these 10 portfolios is 751, which is more than the

theoretical J = 729. However, it is evident that

the optimal portfolios’ performance has a large

variance 8 .

0∣-------------------------------1-------------------------------1-------------------------------1--------------------------------1--------------------------------1--------------------------------1-------------------------------1-------------------------------1-------------------------------1-------------------------------

0 1 2 3 4 5 6 7 8 9 10

x 104

4

2

0 1 2 3 4 5 6 7 8 9 10

years

Fig. 4. Optimal wealth, investment and consump-

tion rate realisations.

0

4.2 Numerical Solutions

8 An estimate of the optimal utility standard deviation

was computed for the same integration parameter set as in

Section 4.2. (I.e., there were 600 noise realisations and the

integration step was .025.) The mean utility was 719.7,

which was 99.5 % of the theoretical expected optimal

performance; the corresponding standard deviation was

165.

The SOC Sol [18] suite of Matlab functions was

used to optimise a portfolio from Section 3. Most

of the problem transformation (e.g., from a con-

tinuous time and space formulation to a discrete

model) is taken care of by the software.

More intriguing information

1. The name is absent2. The name is absent

3. AN EMPIRICAL INVESTIGATION OF THE PRODUCTION EFFECTS OF ADOPTING GM SEED TECHNOLOGY: THE CASE OF FARMERS IN ARGENTINA

4. Restructuring of industrial economies in countries in transition: Experience of Ukraine

5. CONSUMER ACCEPTANCE OF GENETICALLY MODIFIED FOODS

6. Detecting Multiple Breaks in Financial Market Volatility Dynamics

7. Testing Gribat´s Law Across Regions. Evidence from Spain.

8. Multifunctionality of Agriculture: An Inquiry Into the Complementarity Between Landscape Preservation and Food Security

9. The name is absent

10. The name is absent