3500

3000

2500

2000

1500

1000

500

Number of maximisations

StateStep,00!03

■:.....«........

..⅛''

,o

,β

i'......;.........1

State Step .1125

: : .∙∙s"'

.⅛S⅛⅛2.... jo≤

......'ʃ-

.......о............ : :StateStep .15

11--------------------1---------------------1---------------------1---------------------1---------------------1--------------------1---------------------1---------------------1--------------------1---------------------1

11 15 21 25 31 55 41 45 51 55 11

Numoer of Time Steps

Here, w is a one-dimensional standard Brownian

motion, and r, a, σ are constants with r < a and

σ > O. Symbol uɪ(t) denotes the fraction of the

wealth invested in the risky asset at t and U2{t)

is the consumption rate. The agent’s objective

is to find an optimal two-dimensional strategy

и = [ui(2t),[72(2t)], such that

O ≤ uɪ(t) ≤ 1, and U2{t) ≥ O, (27)

and such that maximises expected discounted

total utility

J(O, x(O); u) = IE

e-βt[U2{t)γdt I x(O)

(28)

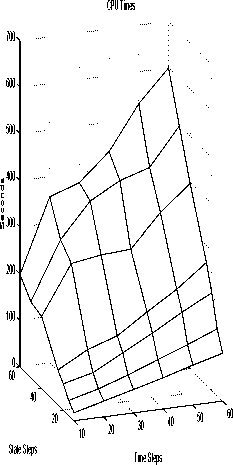

Fig. 1. Computational complexity.

followed the optimal ones, see [8]. However, the

test problems were “easy” in that they contained

a quadratic cost component (they were not linear-

quadratic though). Here, the method will be used

to solve a classical portfolio selection problem

(see [2]) which is a generically stochastic and non

linear-quadratic problem.

given discount rate ρ > O and assuming that

[tf2(t)]7 is the agent’s utility function. Here no

value is assigned to wealth at T while Xq is the

wealth at the initial time O. The problem to

maximise (28) subject to (26) is clearly one of the

class described in Section 2.1.

3.2 The Optimal Solution

The Hamilton-Jacobi-Bellman equation can be

solved for the optimal value function in the fol-

lowing form

H(τ, x) = g(τ)x''i. (29)

3. A PORTFOLIO SELECTION MODEL

3.1 The Model

A simplified version of Merton’s [10] model of

optimal portfolio selection is analytically solved

in [2], pp. 160-161.

The stock portfolio consists of two assets, one

“risky” and the other “risk free”. If the price per

share of the risky asset p{t) changes according to

dp = p{ptdt + σdw)

while the price q per share for the risk free asset

changes according to

dq = qrdt

then the wealth x(t) at time t ∈ [O,T] changes

according to the following stochastic differential

equation

dx = (1 — u±)rxdt + u±x{adt + σdw) — U2dt.

(26)

Function g{τ) can be integrated and equals

p(τ) =

where

1~T

ρ-ι∕y

(1 — e

(g —^7)

1—i

1-7

(30)

(α — r)2

2σ2(l — 7)

+ r.

The optimal investment and consumption strate-

gies ûi and U2 can be computed as

n — r

Û1 = ɑ ʌ 31

σ2(l — 7)

lj2(τ,x) = [eβτg(τ)]~ x. (32)

In this example, only JT2 is a (linear) function

of wealth while ⅛ is constant. Notice also that

the above solution is “internal” in that both con-

straints (27) will be satisfied for some parameter

set. In particular ⅛ ≤ 1 if α — r ≤ σ2(l — 7).

More intriguing information

1. AN ECONOMIC EVALUATION OF COTTON AND PEANUT RESEARCH IN SOUTHEASTERN UNITED STATES2. Backpropagation Artificial Neural Network To Detect Hyperthermic Seizures In Rats

3. Income Mobility of Owners of Small Businesses when Boundaries between Occupations are Vague

4. The name is absent

5. Imperfect competition and congestion in the City

6. PER UNIT COSTS TO OWN AND OPERATE FARM MACHINERY

7. The name is absent

8. The Value of Cultural Heritage Sites in Armenia: Evidence From a Travel Cost Method Study

9. Tax systems and tax reforms in Europe: Rationale and open issue for more radical reforms

10. Modelling Transport in an Interregional General Equilibrium Model with Externalities