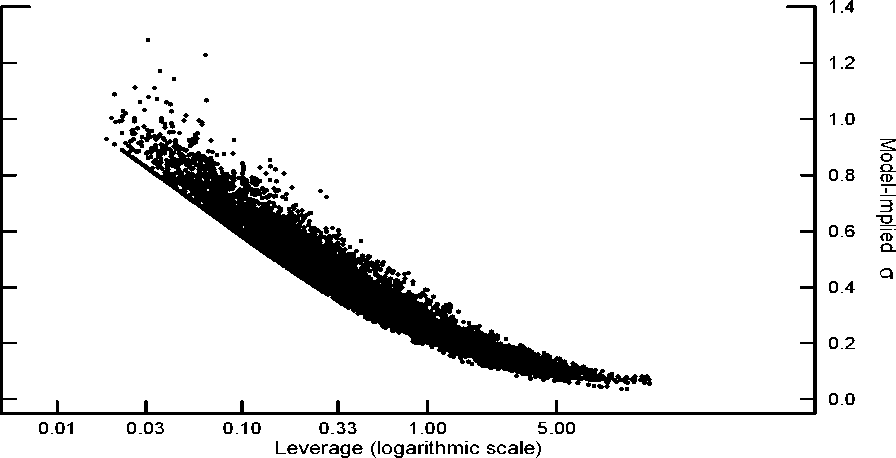

Figure 12

Leverage and Volatility of Idiosyncratic Risk

cannot be explained by the expected default probabilities derived from the option-

theoretic framework underlying the MKMV approach. Thus, once credit rating effects

are excluded, the model-implied spread

financial market frictions—bankruptcy costs and liquidity premiums—and would be

likely wider, requiring in turn a bigger μt.

Rb

R

- *

would incorporate different sorts of

it

The fit of the model, under the specification that excludes credit rating effects, is

greatly improved if we use the model-implied recovery rate as an alternative metric

to evaluate the BGG framework. In fact, as shown in the lower panel of Figure 11,

the model-implied recovery rate is now much closer to the actual recovery rate on

defaulted bonds, particularly since early 2001.

5.3 Limitations of the BGG Framework

In addition to the time-varying bankruptcy cost parameter μt, the other (unobserv-

able) key parameter of the BGG model that we solve for is σit , the firm-specific,

time-varying standard deviation of the idiosyncratic productivity shock. As shown

in Figure 12, the model implies a strong prediction between firms’ leverage and the

33

More intriguing information

1. Delayed Manifestation of T ransurethral Syndrome as a Complication of T ransurethral Prostatic Resection2. The name is absent

3. How do investors' expectations drive asset prices?

4. A Review of Kuhnian and Lakatosian “Explanations” in Economics

5. The fundamental determinants of financial integration in the European Union

6. The name is absent

7. The name is absent

8. The name is absent

9. The name is absent

10. Concerns for Equity and the Optimal Co-Payments for Publicly Provided Health Care