18

PEDRO PABLO ALVAREZ LOIS

from where

(3.21)

dlog (Πzt∕Pt) = 7 /dlog (¾) _ dlog (I-Lt)

d log xt 1 - 7 ∖ d log xt d log xt

which is positive since in the previous proposition it was proven that employment

and output are positively related to an unanticipated monetary policy shock.

Now, from (2.16) one can solve the gross nominal interest rate as a function of

the mark-up, the ratio of intermediate to final-good prices and the wage rate as

follows,

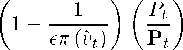

(3.22)

wffp^t

Consequently, the effect on the nominal interest rate due to the unanticipated

monetary shock acts through three channels, namely the mark-up, the price relation

and the real wage rate:

dlog(l + ¾) _ dlog (1 — l∕eτr (⅞)) dlog(Ft∕Pt) dlog(TVt∕Pt)

(3-23) ---—:-------- — ------—:--1--—:--ʌtʌt ---Tj--------

d log xt d log xt d log xt d log xt

The monetary shock rises employment and final output implying a reduction in

the real wage rate. As discussed above, higher employment levels imply a higher

capacity utilization rate and other related variables such as the mark-up and the

proportion of firms producing at full capacity, 1 - π (¾), so that,

∕dlog (1 — l∕eττ (¾))

sign ------71-----------

∖ d log xt

Moreover, the price ratio decreases in response to an unanticipated monetary shock.

This is so because from (2.6) this ratio depends only on the cut-off value ¾, which

is negatively related with the equilibrium level of employment

sign

dk>g(Pt∕Pt)

d log xt

From the discussion above, it follows that the derivative in (3.23) is negative. □

Altogether, this version of the model displays the liquidity effect of a money

supply shock, as well as the other features that characterize monetary economies.

As noted above, the presence of capacity constraints as well as the monopolistic

competitive environment provide a rich source of dynamics. This point will be

discussed in more detail below.

Proposition 3. The magnitude of the response of employment (output) and the

real wage rate to an unanticipated change in the growth rate of money is nega-

tively related with the capacity utilization rate at the time of the shock, whereas the

opposite is true for the nominal rate of interest.

Proof. The strategy of the proof is the following: first it is shown that the magnitude

of the response of employment to the monetary shock depends negatively on the

level of employment at the time of the shock; next it is proven that in a high (low)

capacity economy employment will be higher (lower).

More intriguing information

1. The name is absent2. The name is absent

3. The name is absent

4. An Interview with Thomas J. Sargent

5. Konjunkturprognostiker unter Panik: Kommentar

6. Why unwinding preferences is not the same as liberalisation: the case of sugar

7. An Efficient Secure Multimodal Biometric Fusion Using Palmprint and Face Image

8. Understanding the (relative) fall and rise of construction wages

9. Imperfect competition and congestion in the City

10. Towards a Mirror System for the Development of Socially-Mediated Skills