26

private. This illustrates that both firms and consumers can benefit when firms have large

incentives to protect their reputations.

- Reputation is a public good

—■— Reputation is a private good

• Monopoly

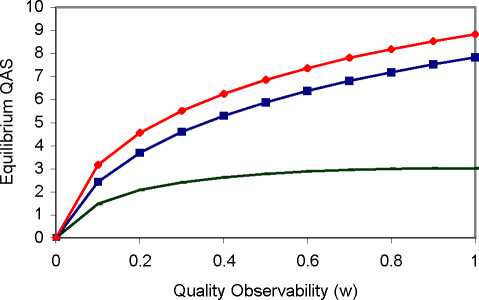

Figure 2. Equilibrium responses of the stringency of controls to changes in quality

observability (a = 50, b = 1, β= 0.9)

Figure 2 shows that as consumers can detect quality deviations more easily, the

equilibrium levels of stringency increase for all market structures and natures of reputation

considered.14 As discussed before, when quality is a credence attribute, firms will find it

optimal not to invest in QASs. Firms do not have incentives to avoid punishments that have

zero probability of occurrence. The level of stringency is always greater when reputation is a

private good. Furthermore, it reveals that the monopolist will provide the highest quality (in

expectations). It is straightforward to show analytically, for the proposed function

specifications, that monopolist will employ more stringent QASs and obtain higher profits than

duopolist with public reputations. Monopolists are the ones that will lose the most if a quality

deviation occurs and is detected.

Figure 3 shows that expected profits decline as consumers can more readily discern

quality. The reason is the increased cost of the optimal QAS and the increased probability that

a firm will lose its reputation. This (envelope) result is not sensitive to the particular

More intriguing information

1. Telecommuting and environmental policy - lessons from the Ecommute program2. Applications of Evolutionary Economic Geography

3. The name is absent

4. 09-01 "Resources, Rules and International Political Economy: The Politics of Development in the WTO"

5. Opciones de política económica en el Perú 2011-2015

6. Orientation discrimination in WS 2

7. Spatial agglomeration and business groups: new evidence from Italian industrial districts

8. On Evolution of God-Seeking Mind

9. Performance - Complexity Comparison of Receivers for a LTE MIMO–OFDM System

10. The name is absent