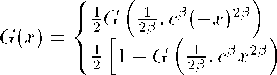

The cdf of X is given by

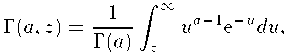

where

being

-f1SEp(≈0 =

(τ⅛∙) g(kx)

for X < 0,

for X > 0,

1 - (ττ⅛λ) G(-)

1 1 + « 2 J V ft /

for x < 0,

for x > 0,

a > 0, z > 0,

the regularized gamma function. G is the cdf of the symmetric exponential power

distribution with zero mean and unit variance obtained when к = 1.

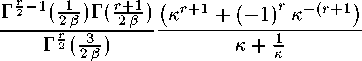

The momemts of order r, r = 1, 2,..., of the SEP distribution are:

E(Xr) =

If 0 ∈ IR is a position parameter and φ > 0 is a scale parameter, then it is possible

to bring back the three distributions to be characterized by four parameters using the

transformation Y = θ + φX. Moreover, the skewness and kurtosis indices can be easily

obtained relating moments from the origin and central moments.

3.2 The experiment

Here we show the results of the Monte Carlo experiment run to interpret the association

parameters of the (5) when the marginals are the three distributions seen above. Ac-

cording to the instruction given in Koehler and Symanowski (1995) samples are taken

from a three-dimensional KS distribution for different values of α12, αl3, '∣2.i and setting

α11 = <∣22 = «33 = 0. For each sample the correlation coefficient as a measure for the

linear relation and the Kendall’s coefficient for the monotone relation are calculated for

all pairs of variables. Table 1 shows the results for samples of size n = 50000, where

the marginals have zero mean, unit variance and, respectively, skewness equal to -0.5,

0, 0.5 and kurtosis equal to 5, 6, 8.

To comment the results, note that changing the values of the association parameters

we obtain very different dependence measures, but no particular links among them can

be pointed out. Moreover, it seems that marginal have not a big effect on the dependence

structure of the KS distribution, because the values of the correlation coefficients and

Kendall’s taus do not vary a lot in the three cases we have studied.

4 Fitting the KS distributions to data

4.1 Data

The raw data used in this paper are weekly prices of four market indices: the SfeP

500 Composite index (SfePCOMP), NASDAQ Composite index (NASCOMP), NIKKEI

500 index (JAPA500) and MSCI AC World index (MSACWFL). The observations have

been obtained by Datastream for the period 1/1/1988 to 12/31/2003. Then, we have

computed the returns as first differences of the natural logarithm of each series, rt =

More intriguing information

1. Effort and Performance in Public-Policy Contests2. DURABLE CONSUMPTION AS A STATUS GOOD: A STUDY OF NEOCLASSICAL CASES

3. CURRENT CHALLENGES FOR AGRICULTURAL POLICY

4. The name is absent

5. Private tutoring at transition points in the English education system: its nature, extent and purpose

6. Word Sense Disambiguation by Web Mining for Word Co-occurrence Probabilities

7. The name is absent

8. Auction Design without Commitment

9. Micro-strategies of Contextualization Cross-national Transfer of Socially Responsible Investment

10. The name is absent